What is the Accounting Equation? Basic & Expanded Formula Explained

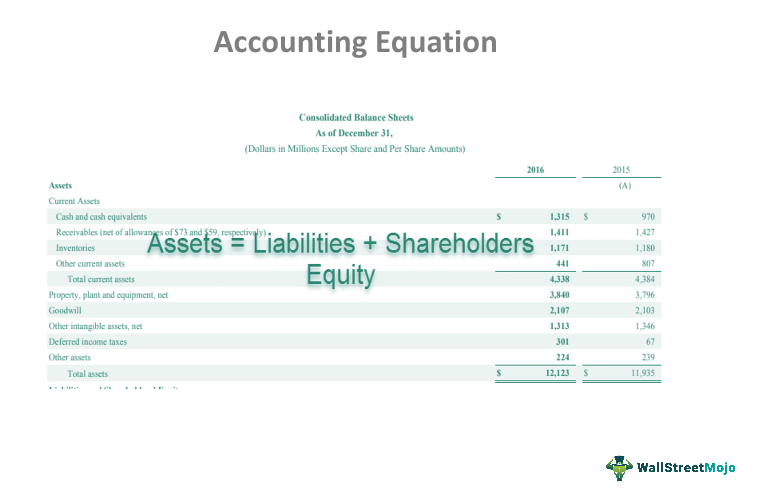

If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle. Equity on the other hand is the shareholders’ claims on the company assets. This is the amount of money shareholders have contributed to the company for an ownership stake.

What Is Shareholders’ Equity in the Accounting Equation?

It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts.

Effect of Transactions on the Accounting Equation

- If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for.

- To illustrate how the accounting equation works, let us analyze the transactions of a fictitious corporation, First Shop, Inc.

- The accounting equation is something that must be understood thoroughly by those who deal with money and those who want to ensure they are making the best decisions financially.

- From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity.

- Think of liabilities as obligations — the company has an obligation to make payments on loans or mortgages or they risk damage to their credit and business.

- On 5 January, Sam purchases merchandise for $20,000 on credit.

Equity is usually shown after liabilities in the accounting equation because liabilities must have to be repaid before owners’ claims. You might also notice that the accounting equation is in the same order as the balance sheet. The owner’s equity is the balancing amount in the accounting equation. So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance. All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s).

Get in Touch With a Financial Advisor

The accounting equation states that the amount of assets must be equal to liabilities plus shareholder or owner equity. Liabilities are claims on the company assets by other companies or people. In other words, it’s the amount of money owed to other people. The bank has a claim to the business building or land that is mortgaged. If the net amount is a negative amount, it is referred to as a net loss. The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance.

What are assets?

Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets. Shareholders’ equity is the total value of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them. The accounting equation matters because keeping track of each transaction’s corresponding entry on each side is essential for keeping records accurate.

The accounting equation is a factor in almost every aspect of your business accounting. There are different categories of business assets including long-term assets, capital assets, investments and tangible assets. They were acquired by borrowing money from lenders, receiving cash from owners and shareholders or offering goods or services. If an accounting equation does not balance, it means that the accounting transactions are not properly recorded. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity.

Our PRO users get lifetime access to our accounting equation visual tutorial, cheat sheet, flashcards, quick test, and more. This is how the accounting equation of Laura’s business looks like after incorporating the how to register vehicles purchased in private sales california dmv effects of all transactions at the end of month 1. In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business.

At this time, there is external equity or liability in Sam Enterprise. The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60. The 500 year-old accounting system where every transaction is recorded into at least two accounts. Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Understanding how the accounting equation works is one of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it.

Long-term liabilities are usually owed to lending institutions and include notes payable and possibly unearned revenue. The inventory (asset) of the business will increase by the $2,500 cost of the inventory and a trade payable (liability) will be recorded to represent the amount now owed to the supplier. In the above transaction, Assets increased as a result of the increase in Cash. At the same time, Capital increased due to the owner’s contribution. Remember that capital is increased by contribution of owners and income, and is decreased by withdrawals and expenses.

One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement.